Personal Finance for Beginners: The Ultimate Guide

Most people think personal finance is a boring topic about making some money, having a savings account, and not maxing out their credit cards. Complicated, and a problem for later — This is wrong. It’s a skill that everyone, no matter your age or career, needs to master. Why? Because how you handle your money can make a huge difference in where you end up.

Whether you’re dreaming of buying your first house, paying off that mountain of student loans, or just having a little peace of mind when life throws something unexpected your way, understanding personal finance is crucial.

I know it sounds intimidating. Terms like “compound interest” and “401(k)” can make your head spin, but don’t worry. I’m going to break everything down into bite-sized, easy-to-understand pieces.

By the end of this guide, you’ll have more knowledge than 90% of people out there and should be able to start making much better decisions about your finances. Let’s dive in!

Understanding The Basics of Personal Finance

Personal finance isn’t just about having enough cash to cover your monthly bills, it’s the full picture of how you manage money over your lifetime. From budgeting for your everyday expenses to planning for retirement, personal finance is about making informed decisions that support your financial goals.

When you fully understand the basics, it can transform the way you handle your money, leading to more stability and less stress. It’s not about being a financial expert, but taking control of your money and using it to create a secure future.

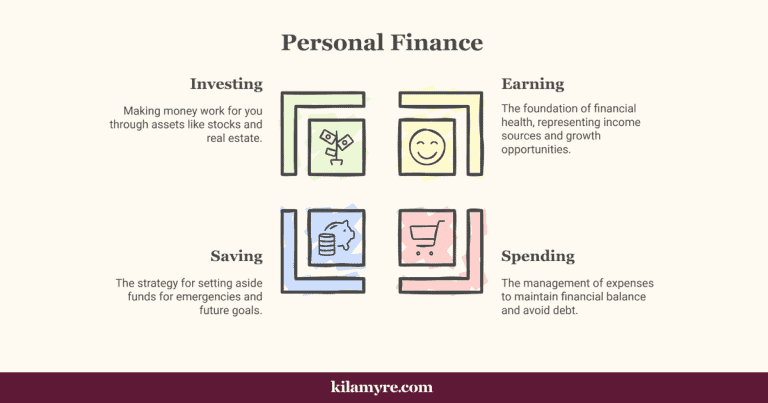

The four Pillars of Personal Finance:

When it comes to personal finance, there are four key areas that make up the foundation of your financial health: earning, spending, saving, and investing. Understanding them changed everything for me, and they will for you. Let’s break each one down:

- Earning: This is where it all starts, how much money you bring in. Whether it’s your salary, side hustles, or passive income, understanding how much you earn is crucial for managing the rest of your money. It’s important to look at your income sources and think about ways to grow them.

- Spending: Money comes in, and money goes out. The key to effectively managing your money is controlling your spending. Tracking your expenses is the first step to understanding where your money is going. Many people make the mistake of not budgeting for everything, leading to overspending.

- Saving: You’ve probably heard this advice a thousand times, but it’s true: you need to save. Whether it’s for an emergency fund, your next vacation, something expensive you want to buy, or your future retirement, having a clear savings strategy is essential.

- Investing: This is where you make your money work for you. While saving is great, it doesn’t build wealth like investing does. Investing in things like stocks, bonds, or even real estate can help you grow your wealth over time.

Setting Financial Goals

Financial goals are basically the things you want to do with your money. But here’s the catch, if you don’t have a clear, specific goal, your money tends to just disappear without you knowing where it went.

Want to save for a down payment on a house? Or maybe you’re feeling the pressure of student loans? Whatever it is, setting specific financial goals will help you stay focused and motivated.

How to Set Effective Goals?

Now, how do you actually set goals that will stick? Because the truth is, just saying “I want to save money” doesn’t get you anywhere. One of the best ways to do this is by using the SMART goal framework. It stands for:

- Specific: You need to know exactly what you’re aiming for. When you have specific financial goals, you’re way more likely to stay focused and motivated. So Instead of saying, “I want to save money,” say, “I want to save $20,000 for a house down payment in two years.” One gives you something real to work towards, while the other… is kind of just wishful thinking.

- Measurable: You need a way to track your progress. Is your goal to save $5,000 in six months? Perfect. Now you know you need to save around $840 a month. Set a target amount or a timeframe.

- Achievable: Be realistic. A couple years ago, I wanted to pay off a chunk of debt, but I was also thinking about starting my emergency fund and investing. It was too much. So, I focused on paying off most of my debt first. Once that was under control, I moved on to the next goal.

- Relevant: Your goal has to matter to you. Don’t chase a goal because someone else says it’s what you should do. You need to focus on what’s important to you.

- Time-bound: Every goal should have a deadline. This gives you something to work toward. It could be paying off $1,000 in credit card debt in 6 months or saving for a vacation in a year. Deadlines help you stay on track.

Short-Term vs. Long-Term Goals & How to Prioritize Them:

Not all goals are created equal, and it’s important to recognize the difference between short-term and long-term objectives. Short-term goals are things you want to accomplish in the next year or so. Think of paying off a credit card or saving up for a vacation.

Long-term goals are your bigger dreams, like saving for retirement or buying a home. Both are equally important, but they require different strategies and timelines.

You might feel like there’s a million things you want to work on, saving, paying off debt, investing. But it’s essential to prioritize. Start with debt reduction, especially high-interest debt like credit cards, because they’ll eat away at your finances.

Once that’s under control, move on to building your savings, like your emergency fund. Finally, start thinking about investing for your future. With the right goals in place, you’re not just spending money aimlessly, you’re working towards something that matters to you.

Creating a Budget

A budget is a plan for how you’ll spend your money. It’s a way to track your income, manage your expenses, and make sure you’re saving for your goals.

It is the first step in taking control of your finances. Without a budget, it’s easy to let money slip through your fingers without realizing it. So, creating one is essential, it helps you live within your means and plan for the future.

How to Create a Budget?

- Track Your Income: First, figure out how much money you’re bringing in each month. This could include your salary, freelance earnings, or passive income streams. Knowing exactly how much you earn is the foundation of any budget.

- List Your Expenses: Next, list out everything you spend money on each month. Separate your fixed expenses (things like rent or car payments) from your variable expenses (groceries, entertainment, or gas). This distinction helps you see where you can cut back if needed.

- Set Your Priorities: With your expenses laid out, it’s time to think about your priorities. Are you focused on paying off your debt or building an emergency fund? Make sure your budget reflects these goals.

- Balance Your Budget: Now that you know your income and expenses, adjust where necessary to make sure you’re not overspending. The goal is to spend less than you earn and put the difference toward your savings or debt repayment. If you’re falling short, that’s when the real magic happens, adjust your variable expenses and make sure you’re spending money wisely.

To really get the hang of budgeting, it is crucial to understand the difference between fixed and variable expenses:

- Fixed Expenses: These are regular, predictable expenses that don’t change from month to month, like your rent, mortgage, car payment, or insurance premiums.

- Variable Expenses: These are the ones that fluctuate each month, such as groceries, utilities, entertainment, or dining out. The key here is that while fixed expenses are non-negotiable, variable expenses are where you have the most flexibility to adjust.

Different Budgeting Methods:

Once you have a handle on tracking your income and expenses, the next step is choosing a budgeting method that works for you. Here are the most common methods to consider:

- 50/30/20 Rule: This is a simple rule where you divide your income into three categories: 50% for needs (like rent or utilities), 30% for wants (like Netflix or dining out), and 20% for savings or debt repayment. It’s easy to follow and works well for beginners.

- Zero-Based Budgeting: This method is a little more hands-on, it helps you assign every dollar of your income to a specific expense or savings goal, making sure that your income minus your expenses equals zero at the end of the month. It’s a great method if you have multiple financial goals and this is the one I personally use.

- Cash Envelope System: If you find yourself constantly overspending on things like dining out or entertainment, the cash envelope system might be a game-changer. With this system, you take cash out for specific categories of spending (like groceries or fun money) and place it in separate envelopes. Once the envelope is empty, that’s it, you’re done spending for that category. It’s a hands-on approach that can help you really visualize and control your spending habits.

There are several apps designed to help you stay on top of your finances. For example, YNAB (You Need a Budget) is a fantastic tool for beginners, with easy-to-follow budgeting methods and plenty of educational resources. Other apps like Goodbudget and Everydollar can also help you track your spending, set goals, and stay organized.

Building An Emergency Fund

Life happens. No matter how much you plan, unexpected expenses can happen at any time. Medical emergencies, vet bills, your car breaking down on you, job loss, or even a surprise home repair can put a serious strain on your finances.

That’s where an emergency fund comes in. It acts as a safety net to cover these unplanned costs without disrupting your financial goals or forcing you to rack up credit card debt. Having an emergency fund in place helps you handle unexpected challenges without stressing over your finances.

How Much Should You Save?

A good rule to follow is to save enough to cover 3 to 6 months of your living expenses in your emergency fund. This will give you enough cushion to cover essential expenses, such as rent, utilities, food, and transportation, if something unexpected were to happen.

If you’re single with no dependents, 3 to 4 months may be sufficient, but if you have a family or someone relying on your income, lean towards the higher end of the range. The key here is ensuring you have enough to stay afloat while you manage through any setbacks.

Where to Keep Your Emergency Fund?

The best place to keep your emergency fund is somewhere that is easily accessible, but also earns some interest. Ideally, you want an account that’s separate from your regular checking account to avoid the temptation to dip into it for non-emergencies.

A high-yield savings account is a great option because it offers a higher interest rate than a standard savings account, allowing your emergency fund to grow a little while remaining liquid. Many banks offer these accounts with minimal fees, so you can keep your emergency savings safe and accessible without it being a hassle.

By having an emergency fund in place, you’re not just protecting your finances, you’re also setting yourself up for long-term financial security.

Managing Your Debt Wisely

There are two types of debt. “Good debt” and “bad debt”, and knowing the difference can shape how you approach repayment. Bad debt is the first thing anyone should focus on, it usually comes from high-interest borrowing, such as credit card balances or payday loans, which can quickly spiral out of control if not managed.

There are two popular strategies for paying off debt:

- The Debt Snowball Method: This approach focuses on paying off your smallest debts first while making minimum payments on larger ones. As each smaller debt is paid off, you roll that payment into the next debt. It is highly motivating because you can see progress.

- The Debt Avalanche Method: With this strategy, you focus on tackling the debt with the highest interest rate first. This can save you more money over time, but progress might feel slower since you’re targeting larger balances upfront.

Both methods work, so pick the one that fits your personality and gives you the motivation to stick with it.

Refinancing and Consolidation:

Refinancing allows you to replace your current debt with a new one at a lower interest rate, saving you money over time. For example, refinancing student loans can lower monthly payments and reduce the total interest paid.

Debt consolidation, on the other hand, combines multiple debts into a single loan, simplifying your monthly payments. It’s particularly helpful if have several credit card balances or loans. However, be careful, while these options can provide relief, they require discipline to avoid taking on new debt while paying off the consolidated loan.

To get started with refinancing or debt consolidation, know your numbers, what you owe, interest rates, and your credit score. Compare offers from banks, credit unions, or online lenders like SoFi and LendingClub. Tools like NerdWallet can help you find the best rates. For more tips, check out the CFPB’s guide to debt consolidation for a clear breakdown of your options.

Saving Money

Saving money is probably the most important part of your personal finances. It ensures you’re prepared for unexpected expenses, major purchases, or opportunities. But saving isn’t just about setting cash aside, it’s about putting it in the right place where it can grow or remain accessible when you need it.

Here are a few common types of savings accounts:

- Standard Savings Account: Great for easy access to your money, but they usually offer low interest rates, so your money doesn’t grow much overtime. They are best used for keeping your fund safe and liquid rather than building long-term wealth.

- High-Yield Savings Account: Similar to standard savings but with a higher interest rate. HYSAs help your money grow faster over time through compounding interest. These accounts are often offered by online banks, which keep fees low and pass those savings on to you. They are an easy, hands-off way to make your savings work harder.

- Certificates of Deposit (CDs): A secure way to earn higher interest, but your money is locked in for a specific term. CDs are perfect for goals with a clear timeline.

The type of bank you choose depends on your goals and preferences. If you value high interest rates and easy access, consider online banks like Ally or Wealthfront, which often offer higher yields on savings accounts compared to traditional banks.

If you prefer in-person service or already bank locally, a traditional bank or credit union might be the right choice. Other factors to consider include fees, minimum balance requirements, and accessibility, like whether the bank has a solid mobile app or user-friendly online tools.

No matter where you decide to save, the key is to start. Even a small deposit can grow over time, especially if you consistently contribute and choose the right account for your needs.

Investing Your Money

I remember staring at my first investment account statement feeling completely lost. All those terms and numbers might as well have been written in another language. But here’s what I’ve learned, investing isn’t nearly as complicated as people make it seem. Let’s break it down into plain English.

Investing is using your money to buy assets like stocks, bonds, or real estate with the goal of increasing its value over time. Instead of letting your money sit in a savings account, you’re working to make it earn more.

While there are always some risks, investing gives you the opportunity to build wealth and achieve long-term financial goals.

Types of Investments Made Simple:

- Stocks: When you buy stocks, you’re actually buying tiny pieces of ownership in companies, meaning when you buy one, you become a partial owner and can earn money if the company does well. It’s a higher-risk investment because the value of stocks can go up or down, but the potential returns are much greater. Companies like Apple, Microsoft, or Amazon are examples of stocks many people invest in.

- Bonds: These are basically loans you give to companies or governments. They promise to pay you back with interest. They’re generally more stable. It’s like being the bank instead of the customer, but the returns are usually lower compared to stocks.

- Mutual Funds: Imagine a big basket filled with different investments. That’s essentially what a mutual fund is. Professional managers handle the buying and selling, and you own a piece of everything in the basket. These are great for beginners because they provide instant diversification.

- ETFs (Exchange-Traded Funds): These are similar to mutual funds but can be bought and sold like stocks. They often have lower fees and are more tax-efficient.

How to Get Started with Investing:

- Start with a budget: Don’t jump into investing until you have a solid budget in place. It’s important to know how much you can afford to invest each month without cutting into your emergency fund or leaving yourself short for essential expenses.

- Set up an investment account: The next step is opening an investment account. I started with a simple brokerage account, which you can do online through platforms like Vanguard, Fidelity, or even apps like Robinhood. It’s way easier than it sounds and it allows you to buy stocks, bonds, and mutual funds with a few clicks.

- Don’t put all your eggs into one basket: When I started investing I was tempted to put all my money into TSLA (Tesla). But thankfully, I did some research and realized the importance of diversification, which means spreading your money across different types of investments to reduce risk. That’s when I started investing in ETFs and index funds. They’re perfect for beginners because they automatically give you exposure to a variety of stocks or bonds.

- Start small: Begin by setting aside a small amount each month, even if it is just a little. Contribute what you can within your budget and gradually increase it as you go. It might not seem like much at first, but consistent contributions will add up over time and make you feel more confident to keep going.

- Last but not least, RESEARCH: Before jumping into any investment, I highly recommend doing your homework. Understanding what you’re investing in, whether it’s a stock, bond, or mutual fund, will help you make smarter decisions. I have made the mistake of diving into some investments in the past without fully researching them, and it cost me (RIP my $4,000 worth of NTFs). Take the time to read up on companies, market trends, and the specific type of investment you’re considering.

The Magic of Compound Interest:

Compound interest is where things get exciting. It’s essentially earning interest on your initial deposit and the interest it generates. Compound interest is like a snowball rolling downhill, getting bigger and bigger over time.

Let’s look at a real example: If you invest $100 a month at an annual return of 7%, you’d have approximately $17,300 after 10 years, just by letting your money grow. This is why starting early matters; the longer your money compounds, the greater the rewards.

Retirement Planning:

Planning for retirement is one of the most important parts of investing. Accounts like 401(k)s and IRAs (Individual Retirement Accounts) are designed to help you build a nest egg while enjoying tax advantages.

401(k)s: These are retirement accounts offered by employers. The money goes in before taxes, lowering your taxable income. Many employers offer matching contributions. If your employer offers a 4% match, they’ll add 4% of your salary to your 401(k) when you contribute that amount. For example: if your salary is $50,000 and your employer offers a 4% match, that’s $2,000. If you contribute 4% of your salary (another $2,000), your employer will add their $2,000 to your account. So instead of just saving $2,000, you now have $4,000 saved. That is essentially free money because it’s money you wouldn’t get otherwise unless you contributed to your 401k.

IRAs: (Individual Retirement Accounts): There are two main types of IRAs, Traditional and Roth IRA. Traditional IRAs offer tax breaks upfront, meaning you get a deduction on your taxes before contributing. Roth IRAs are different, you pay taxes on the money now, but everything you earn in the account comes out tax-free in retirement.

Getting Started: Taking Action

The most important step is simply starting. You don’t need thousands of dollars, many investment platforms let you start with just a few dollars. Consider opening an IRA or increasing your 401(k) contributions if you have access to one. Look for low-cost index funds or ETFs that track broad market indexes as a simple way to begin.

If you have questions about getting started, check with your employer about 401(k) options or research reputable investment platforms that offer educational resources for beginners. The sooner you begin, the more time your money has to grow through the power of compound interest.

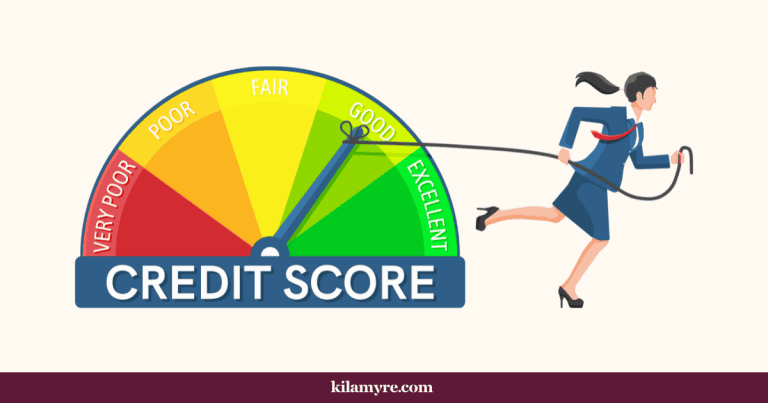

Understanding Credit

Let’s cut through the confusion about credit scores. While everyone talks about them like they’re the most important number in the world, the truth is a little different. I spent a good amount of time obsessing over my credit score before realizing it’s just one piece of the financial puzzle, and sometimes not even the most important one.

What is Credit, Really?

Credit is basically a financial report card that tells lenders how reliable you are with borrowed money. But unlike your high school GPA, this score actually impacts your adult life in significant ways – from renting apartments to getting better insurance rates. Your credit history is like a financial fingerprint that shows how you’ve handled debt over time.

How Credit Scores Work:

Your FICO score (the most commonly used credit score) ranges from 300 to 850 and is calculated using five main factors:

Payment History (35%): This is the most important credit factor. Making payments on time is absolutely crucial. Even one late payment can stick around on your report for up to seven years.

Credit Utilization (30%): This is how much of your available credit you are using. Keeping this under 30% is ideal, so if you have a $10,000 credit limit, try to keep your balance below $3,000.

Length of Credit History (15%): The longer your credit accounts have been open, the better. This is why closing old credit cards can actually hurt your score.

Credit Mix (10%): Having different types of credit (credit cards, car loans, etc.) can help your score, but don’t take out loans just for this reason.

New Credit (10%): Every time you apply for new credit, it creates a hard inquiry on your report. Opening too many of these can lower your score.

Building and Maintaining Good Credit:

Here’s what actually works for building credit:

- Pay on time, every time: Late payments are credit score killers. Set up automatic payments for at least the minimum amount due.

- Watch your credit utilization: Keep your credit usage below 30% of your total limit.

- Don’t close old accounts: Length of credit history matters, so leave your oldest credit cards open (as long as it doesn’t have an annual fee)

- Use credit cards for regular expenses but pay them off each month.

- Monitor your credit report regularly for errors. (get free reports at AnnualCreditReport.com)

- Avoid maxing out your cards, even if you pay them off monthly.

When Does Your Credit Score Really Matter?

Your credit score matters most when you’re planning to borrow money, or apply for a lease or a car loan. But if you’re not planning to borrow soon, don’t stress too much about small dips in your score.

Remember, good credit is a tool, not a goal in itself. Focus first on building strong financial habits, paying bills on time, living within your means, and saving for emergencies. These habits will naturally lead to good credit over time, while also building real financial security.

Useful Resources

- Check your credit report for free: Use AnnualCreditReport.com to monitor your score.

- Tools like Credit Karma or Experian can help track progress and offer tips for improvement.

- For deeper insights, check out the CFPB’s credit building guide.

Insurance And Protection

Insurance isn’t the most exciting part of personal finance, but it’s one of the most important. Think of it as your financial safety net, without it, one unexpected event could wipe out your savings or leave you drowning in debt.

The 5 Types of Insurance You Need:

- Health Insurance: This isn’t just about covering doctor visits. Good health insurance protects your finances from catastrophic medical bills. Look beyond the monthly premium, and understand your deductible, out-of-pocket maximum, and coverage network.

- Life Insurance: Think of this as income replacement for your loved ones if something happens to you. Term life insurance is typically the most cost-effective option.

- Auto Insurance:This isn’t just about protecting your car, it’s about protecting your assets if you’re in an accident. The minimum required coverage rarely provides enough protection.

- Property Insurance: Covers your home and belongings in case of damage or disasters. Whether you’re a homeowner or renter, property insurance is crucial.

- Disability Insurance: Replaces a portion of your income if you’re unable to work due to illness or injury. Often overlooked but incredibly important.

Insurance helps you manage risk. It’s about preparing for the “what ifs” in life, what if you get into an accident, what if a medical emergency arises, or what if your house gets flooded? Having the right insurance means you won’t have to dip into your emergency fund or savings to cover those costs.

Insurance is about protecting what matters most, your health, your family, your home, and your financial future. It’s not one-size-fits-all, so take the time to assess your needs and shop around for the best coverage.

Compare policies online at Policygenius or NerdWallet. Check if your employer offers discounted insurance plans for health or disability coverage.

Understanding Taxes (And Not Freaking Out Every April)

Remember the first time you saw how much was taken out of your paycheck? That was my introduction to the wonderful world of taxes. While taxes might seem overwhelming, understanding the basics can save you money and reduce stress.

Let’s break this down into manageable pieces.

What Are Taxes, Really?

Think of taxes as your subscription fee for living in a functioning society. They go to the government to fund public services, like roads, schools, and healthcare. There are several types you’ll encounter:

Income Tax: This is the big one that comes out of your paycheck. It’s based on how much you earn and includes federal, state (in most states), and sometimes local taxes. The U.S. uses a progressive tax system, meaning the more you earn, the higher percentage you pay.

Sales Tax: That extra percentage added to most purchases. It varies by state and even city. Some places have none, while others might charge over 9%.

Property Tax: If you own a home or property, you’ll pay these annually based on your property’s assessed value.

Payroll Taxes: These fund Social Security and Medicare. You pay 6.2% for Social Security (up to a certain income limit) and 1.45% for Medicare, with your employer matching these amounts.

Taxes directly impact how much money you take home and what you can do with it. For example, the more you earn, the higher your tax bracket may be, which means a larger portion of your income goes to taxes. Understanding this helps you plan better and make smarter financial decisions.

How to Prepare for Taxes

Don’t wait until April to think about taxes. Here’s what to do instead:

Keep organized records:

- Create a simple folder (physical or digital) for tax documents.

- Save receipts for deductible expenses.

- Track any side hustle income.

- Document charitable donations.

Common tax deductions to track:

- Charitable contributions.

- Student loan interest.

- Home mortgage interest.

- State and local taxes paid.

- Retirement account contributions.

- Work-related expenses (if you’re self-employed).

Filing Taxes: DIY or Professional?

If your situation is simple (just W-2 income, standard deduction), tax software like TurboTax or H&R Block works great. These online platforms walk you through everything step-by-step and often offer free filing for simple returns.

Consider hiring a professional if you:

- Are self-employed.

- Own rental property.

- Have multiple investment accounts.

- Recently experienced major life changes.

- Need to file in multiple states.

Taxes are an essential part of personal finance that everyone needs to understand. They can feel complicated at first, but with a little preparation, you’ll get the hang of it. For more details, check out the IRS website for beginner-friendly resources.

Conclusion

Financial education isn’t a destination, it’s a journey. It’s not about getting everything perfect from the start, but about constantly learning and adapting.

The more you know, the better choices you can make for your financial future.

Whether you’re working on saving for a house, building an emergency fund, or planning for retirement, staying educated will help you feel confident in every move you make.